Unlock Vietnam Real Estate H1/2025 - A Whirlwind of Breakthrough Growth

🇻🇳 Vietnam – The Rising Destination for Asian Real Estate Capital

Vietnam’s real estate market is entering a phase of powerful resurgence in 2025. After a period shaped by government caution, a new wave of reforms and capital inflows has set the stage for breakthrough growth. Legal bottlenecks are being cleared, public infrastructure spending is at record levels, and foreign investors are increasingly eyeing Vietnam as Asia’s next property hotspot.

But where exactly are the opportunities—and which risks should investors keep an eye on? Our Vietnam Real Estate H1/2025 Report goes beyond the headlines, decoding the data and revealing trends that will shape investment strategies over the next three years.

Methodology & Scope

- Data sources: on-the-ground tracking in Hanoi & HCMC+, developer disclosures, lease comps, macro datasets benchmarked against segmental models.

- Full report: dashboards by city/region, price-band heatmaps, supply timelines, and 3-year scenarios (2025–2027).

- This teaser: directional trends with key datapoints; full datasets, charts, and risk ranges available in the downloadable report.

MACRO OVERVIEW

| US$ 7.5% | US$ 22 BN | 3.3% |

|---|---|---|

| GDP Growth H1/2025 | Total registered FDI H1/2025 | YoY CPI Increase H1/2025 |

Vietnam’s GDP growth in the first half of 2025 outpaced expectations, driven by manufacturing resilience and domestic consumption. Registered FDI surged over 30% y-o-y, reinforcing Vietnam’s position as a magnet for international capital. Tourism, too, has fully bounced back—surpassing pre-pandemic levels.

⚠️ Yet, not everything is smooth sailing: new U.S. tariffs and global trade tensions are creating fresh uncertainty. How will these shape market sentiment?

Vietnam Market Report H1/2025 - your snapshot of key real estate sectors in Ha Noi and Ho Chi Minh City for smarter investment moves.

Download the H1/2025 Market Report for a clear view of Viet Nam’s real estate landscape.

RESIDENTIAL

Hanoi

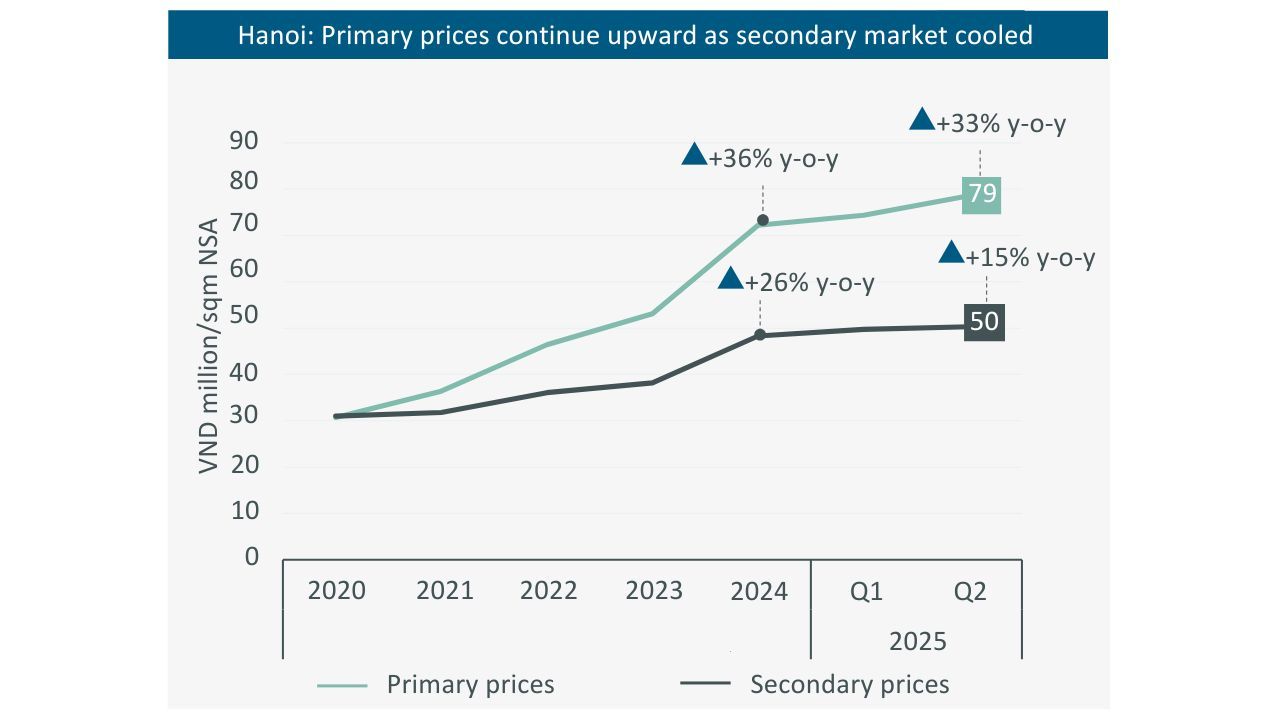

In H1/2025, Ha Noi’s residential market was dominated by high-end and luxury supply, with primary condominium prices reaching VND 79 million per sqm (+33% y-o-y) and landed property prices averaging VND 229 million per sqm (+13% y-o-y). Total market absorption remained healthy at 85% for condominiums and 175% for landed properties.

Ho Chi Minh

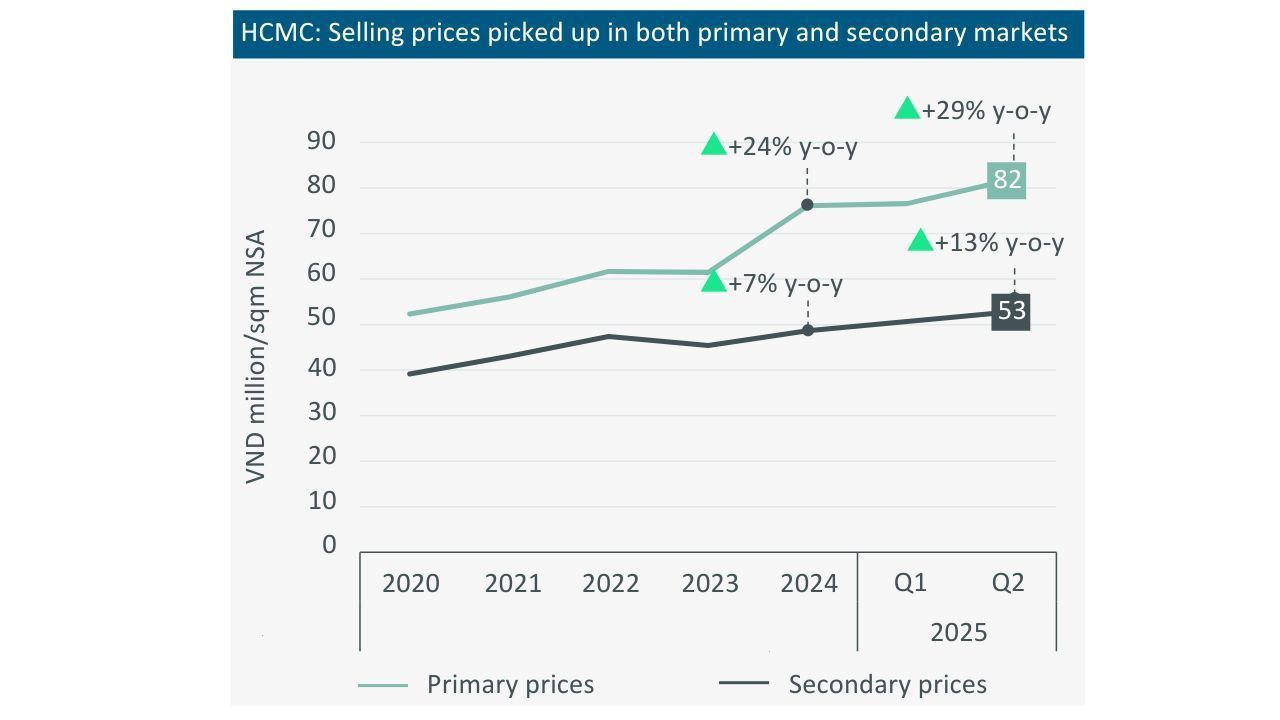

New-build scarcity hit a multi-year extreme; yet peripheral corridors did the heavy lifting on price discovery: selected Long An pockets printed ~90% y/y gains off a low base, while Binh Duong (+~14%) and Dong Nai (+~15%) tracked steadier climbs. The spread between city-core and near-core yields is widening-an early tell for portfolio rebalancing.

OFFICE

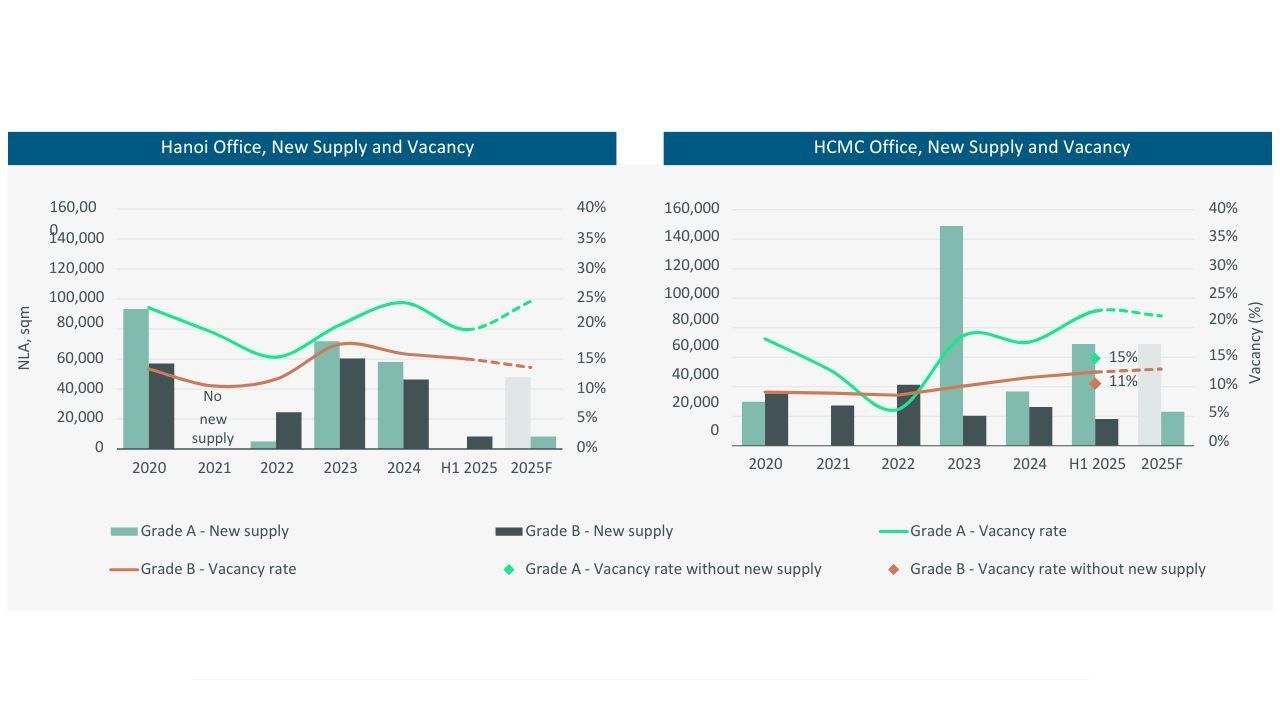

In H1/2025, Hanoi's grade A face rents edged up to around US$31.8/m²/month, with vacancy mechanically higher on new deliveries; Grade B stabilized near mid-teens vacancy as cost-sensitive tenants consolidated. Flight-to-quality stayed real, led by IT and financial services.

In Ho Chi Minh City, Grade A averaged ~US$48/m²/month; Grade B logged roughly +5% y/y. Expansion deals increased, but evaluation cycles lengthened. The rent-value equation shifted just enough for some occupiers to weigh fringe-core addresses where new infrastructure is closing the gap.

INDUSTRIAL & LOGISTICS

In Q2/2025, industrial land rents averaged US$139 per sqm per term in the North (+4% y-o-y) and US$179 per sqm per term in the South (+3% y-o-y). Ready-built warehouses (RBW) and factories (RBF) continued to enjoy healthy demand, particularly in the South, where RBW rents reached US$5.2 per sqm per month (+6% y-o-y).

Market momentum was supported by ongoing manufacturing diversification, proposals for new Free Trade Zones in Ba Ria–Vung Tau and Dong Nai, and provincial mergers that unlocked significant industrial land banks, most notably the 15,500 hectares in Greater HCMC.

RETAIL

CBD rents diverged further: Ha Noi ~US$175/m²/month, HCMC ~US$280/m²/month (+~15% y/y). Lifestyle and F&B continued to lead footprints, with a visible wave of mainland Chinese brands entering at mid-to-premium price points. Non-CBD held steady around US$37–50/m²/month depending on city and scheme quality. Turnover-linked structures gained share as landlords prioritized curated mix over raw occupancy.

Full report detail: trading density benchmarks, category-by-category expansion lists, and center-level lease structures.

Outlook 2025–2027 (Signals To Watch)

- Policy cadence: legal clearing speed vs. new issuance; practical time-to-land-use conversion.

- Funding: developer refinancing windows, presales velocity, and bank appetite by asset class.

- Infrastructure: corridor completion timelines translating into valuation step-ups (or not).

- External: tariff paths, supply-chain relocations, and the FX/rate backdrop for cross-border buyers.

Get the Complete Picture

This overview is designed to orient, not exhaust. The full H1/2025 Vietnam Real Estate Market Report includes the granular numbers, charts, and risk-adjusted opportunity maps that investors use to commit capital with conviction.

Download the full report to access sub-market dashboards, comparables, and our 3-year scenario framework-plus a curated shortlist of assets aligned to each strategy track.