Vietnam Real Estate Market Insights Q3/2025: Key Movements Shaping the Market

As Vietnam’s real estate landscape continues to evolve across office, retail, industrial & logistics, and residential, the third quarter of 2025 reveals a number of meaningful shifts that will influence investment strategies heading into 2026.

Our latest Vietnam Real Estate Market Insights Q3/2025 highlights the most important developments, backed by on-ground observations and market activity across major cities.

Below is a selective overview of notable themes reflected in the report - designed to provide clarity while preserving the depth of analysis available in the full version.

Key Market Highlights – Q3/2025

Vietnam is entering Q3/2025 with exceptional momentum, reinforced by global headlines highlighting stronger-than-expected GDP growth, rising FDI commitments, and upgraded market status from major financial institutions. With manufacturing expansion accelerating and domestic demand remaining a key economic engine, Vietnam continues to stand out as one of Asia’s most resilient and high-potential markets-setting a solid macro foundation for this quarter’s key real estate statistics.

| Category | Key Data | Details |

|---|---|---|

| Retail Expansion | 52 new stores | GS25 +36 • KKV +6 • Mr. D.I.Y +6 • 7-Eleven +4 |

| Upcoming Retail Supply | ~80,000 m² NLA | Vincom Mega Mall Ocean City • AEON Xuan Thuy Hanoi Centre |

| Office & Mixed-Use Pipeline (Hanoi) | ~122,000 m² | Pearl Tower • Westlake Square • Thiso Mall Westlake • Starlake |

| Industrial & Logistics | 4/4 indicators ↑ | Leasing ↑ • Land-bank ↑ • New zones ↑ • RBF demand ↑ |

| Residential Market | < VND 100 million/m² | Dominant price band for new launches |

Download the Q3/2025 Market Report for a clear view of Viet Nam’s real estate landscape.

Ho Chi Minh City – Q3/2025 Overview

HCMC maintained a positive performance thanks to strong domestic spending and stable foreign investment.

- Retail: Healthy occupancy; lifestyle, fashion & F&B brands continue expanding.

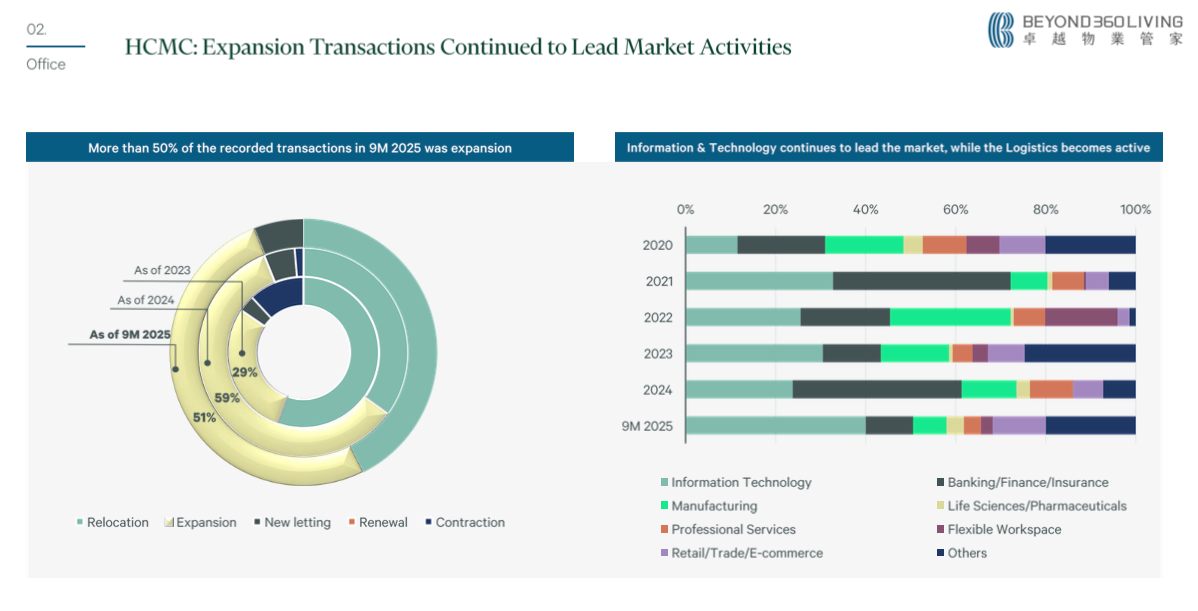

- Office: Steady demand from ICT and professional services; stable rental levels.

- Hotels & Serviced Apartments: Higher occupancy from returning tourists and business travelers.

- Residential: New supply limited; prices expected to rise; buyers shift to satellite areas.

Hanoi – Q3/2025 Overview

The capital recorded an active quarter across most sectors.

- Retail: Rentals increased; occupancy improved; experiential retail drives demand.

- Office: Stable rents and improved occupancy in inner districts; strong tenant retention.

- Hotels & Serviced Apartments: Supported by international arrivals, MICE activity, and FDI-driven expat demand.

- Residential: Mid–upper mid segment remains dominant, aligned with market affordability.